Why Bratislava needs a convention centre?

Positive effects of the new congress infrastructure

Having been without a world-class venue for hosting demanding events, Bratislava is eager to welcome a new convention centre. Bratislava, competing with more-renowned neighbours Vienna and Budapest, is set to make a statement within the meetings industry. Considering that Bratislava is a large-size destination, it needs a venue that can host international events for up to 2000 participants – capacities that the new convention centre will bring. The event world is digitalising, and Bratislava is quickly adapting to the technological revolution. A new convention centre shall combine Slovakian know-how with the latest technological advancements.

The new multifunctional convention centre will meet Bratislava’s real needs and shall foster cultural and congress tourism. Furthermore, a new convention centre will have unprecedented economic benefits for the city while significantly boosting tourism. A generously designed cultural and social space that only such a venue can create, is vital for Bratislava as it will show the world how unique the city is.

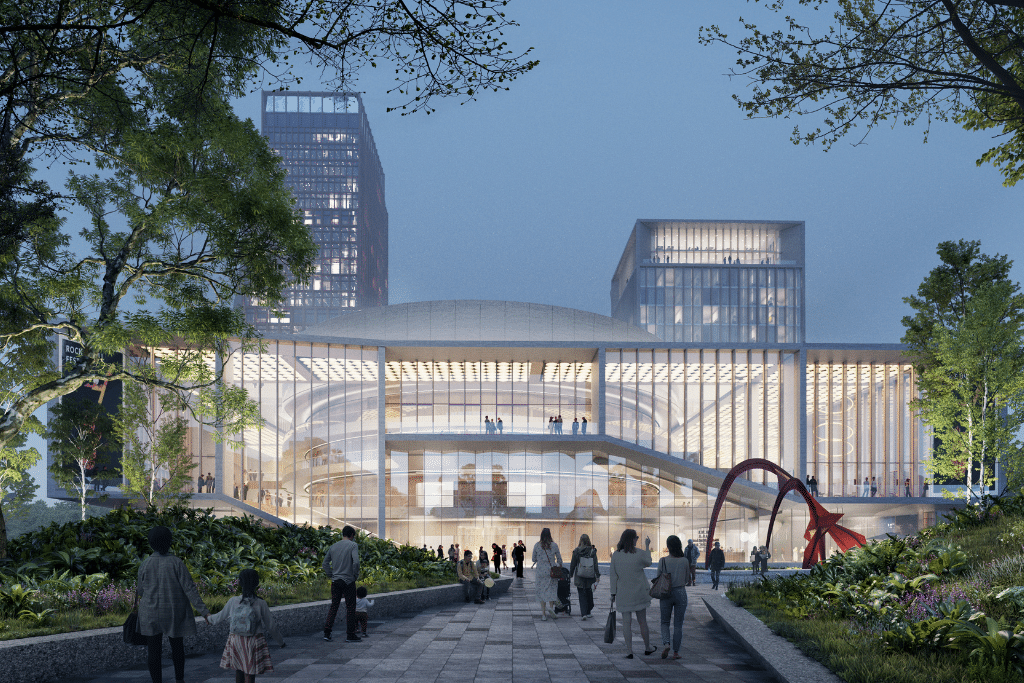

Nove Lido

Currently, three projects are planned for a new convention centre; however, none of them is yet confirmed. Nove Lido, Incheba and Novy Istropolis are the projects that might fill the gap that Bratislava has in the field of a new convention centre.

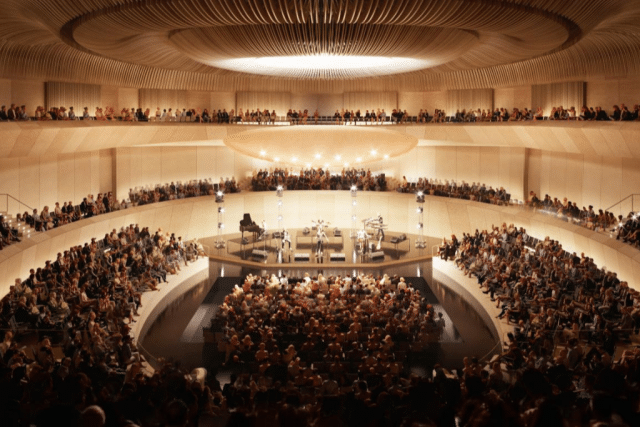

Novy Istropolis

Bratislava – analysis of information from the MTLG research

The analysis of data from this year’s Meeting Experience Index by Kongres Magazine goes to show how much Bratislava needs a new convention centre. In the past few years, Bratislava has placed among the top ten leading congress destinations in the L category (destinations that can host up to 2,000 participants). This year, it took fifth place with an average score of 4,42, just behind The Hague, Zagreb, Ljubljana and Tallinn.

The excellent result is, above all, the outcome of several factors, most notably in the field of the convention bureau’s marketing activities. Moreover, the city’s great general and tourist infrastructure contributed to the final score. Bratislava has 3,198 hotel rooms in the 4-and-5-star categories and is home to 26 hotels. The latter is a cornerstone for the further development of congress tourism. However, two important indices are problematic:

1. Index Hotel Rooms/Theatre Hall Maximum Capacity

For Bratislava, the index is 27,20, the lowest among the top ten destinations. In essence, this can be interpreted that the number of hotel rooms enables to host much larger events than Bratislava hosts today. If a minimum index of 80 is the threshold for similar destinations, Bratislava would desperately need a congress hall that could capacitate up to 2,500 congress guests. The entire congress infrastructure enables this.

2. Index Banquet Hall Maximum Capacity/Theatre Hall Maximum Capacity

For Bratislava, the index is 145,24, a good balance, although the current capacity is too small. Therefore, in practice, Bratislava should feature a hall that could capacitate up to 2,500 participants in a theatre setting (currently 870) and a banquet hall that could welcome at least 1400 attendees (currently 599).

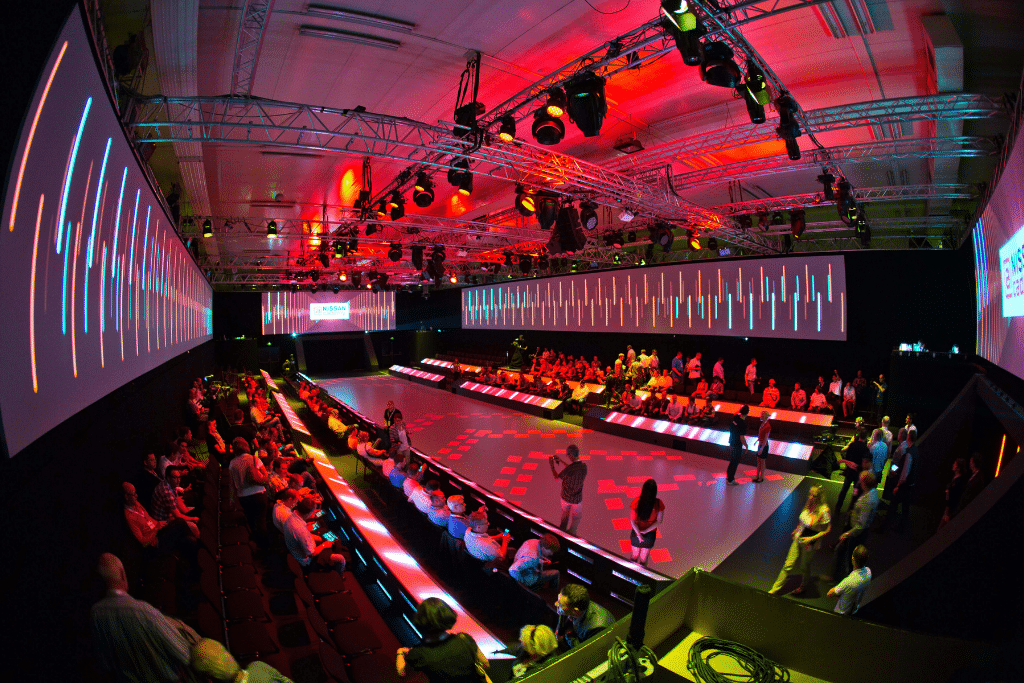

Incheba

The congress tourism market is immensely competitive. To position Bratislava on the international congress market, extensive investments have to be made both in the public and private sectors to support the development of the much-needed congress infrastructure.

Due to its excellent geopolitical location, Bratislava could satisfy the demand for regional meetings of medium and small size. The current congress offer in Bratislava, however, cannot in all aspects cater to such demand. The new multifunctional centre for 2,500 participants could bring about a change in this segment, and attract new congresses, conferences and meetings to Slovakia’s capital. Next to hosting medium-sized events (from 1,500 to 2,500) participants, the new multifunctional centre could also attract several smaller-sized meetings and events.

Alongside the direct impacts the addition of the new convention centre will have, it will be even more important due to its indirect effects. Above all, this will be the improvement of the tourist image of the destination. The research of indirect impact below compared Bratislava to destinations that have due to the development of congress activities achieved impressive development results.

Positive effects of the new congress infrastructure:

– tax benefits (creating additional income for the state)

– creating new workplaces

– encouraging investments and fostering business partnerships

– additional cultural and educational infrastructure for Bratislava

– promotion of local economy and Bratislava as a tourist destination

– accelerated development of technology and science and encouragement for entrepreneurship

Positive effects specifically for (congress) tourism:

– the main tourist season is deseasonalized

– the return of congress guests to the destination as holiday visitors

– congress guests often prolonge their stay at the destination

– congress guests are known as the best consumers of additional tourism offers (shopping, gastronomy, auxiliary services)

– congress guests are free ambassadors of the destination

There is only a handful of highly profitable convention centres in the world. Convention centres are usually understood as crucial infrastructure, generating tourist income and creating new workplaces. Operational results of a convention centre are usually measured through multiplicative effects.

Numerous convention centres are owned by destinations. The main management models of convention centres are:

a) management is controlled entirely by the destination; there are several options:

– the city/destination owns the company in charge of the convention centre, and the company has ownership over all land of the property

– the ownership of real estate is separated from management, and is owned by the city/destination; the convention centre is managed by a corporation owned by the city/destination

– the city manages the convention centre via its expert service; however, no particular corporation is established

b) the city has a majority stake in a corporation that manages the convention centre (usually a stock corporation, where the majority stake is owned by the city/destination)

c) the owner of real estate (usually the city or stock corporation) gives the management of the convention centre into the hands of a specialised management company

d) PPP model – the city or country is the owner of the property and gives it to a corporation that invests and manages the convention centre for 25 years

e) the owner and manager of the convention centre is private capital

A detailed analysis of convention centres has shown that the destination or country is always the most important player regarding development and investments made into convention centres across Europe. For the management of such centres, numerous models have been developed. Research into financial income has shown that among all the convention centres in the analysis, the most successful models were those where the management company was not owned exclusively by the destination or country.

It will be of great interest to continue following Bratislava’s further development, and we hope that the convention centre opens its doors soon.